If you are not using Palmpay then you are missing a lot. I am here to show you the things you are missing that you hardly see anywhere else. Palmpay is one of the best fintech mobile apps designed to help you transfer funds and receive payments, pay for your GOtv/DStv, buy airtime and data. Most importantly with Palmpay you have access to instant loans without collateral or paperwork.

Note: This post is not promotional, that means I was never paid or even encouraged in any way to write about Palmpay. I am writing about them because I am 100% sure that you will appreciate me for putting you in the right direction.

Why I choose Palmpay

Below are the list of the features that Palmpay possesses that made me stick with the platform.

- Well designed mobile App with advanced features

- Free Transfer to any bank

- Access to different loan offers

- Special offers and discounts for using their services

- Good customer support.

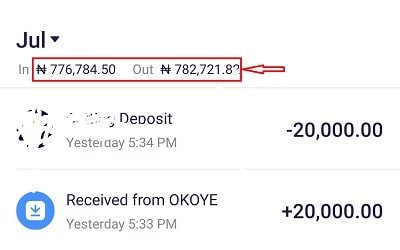

I have listed some of the things that made Palmpay special but you need to see my explanations and proofs. I have some screenshots to back up my claims. To show you that I am a Palmpay regular user, I have in my monthly transaction list 700k+ IN and 700k+ OUT only this month July 2024 which is just 8 days gone today.

The high transaction is not because I am reckless with spending but because I have a sports betting shop that requires regular funding. I also do other transactions with the app because they are better than any banking app that I have used. Below is the screenshot of my transactions.

Well designed mobile App with advanced features

Palmpay is designed in such a way that everything becomes easier like never. If someone sends an account number to you which usually comes with the receiver’s name and the bank name, highlight and copy everything.

Open your Palmpay app and click money transfer to the bank , paste the copied details to the space and you will see how Palmpay app will leave the name and bank name and only paste the needed 10 digital account numbers. The app traces the bank the number belongs to without you manually choosing the bank.

Unlike most banking mobile app, I have not encountered any issues with Palmpay app in terms of the app stability and most importantly the app knows when there is a network issue and will keep you informed about the receiving bank network status before you proceed with your transaction.

Free Transfer to any bank

With Palmpay you can send money to any bank without paying a Kobo as transaction fee or stamp duty, everything is 100% free. No SMS charges, I remembered paying up to 2k for SMS charges from my GTbank with daily electronic transaction charges which range from N50 – N100 daily, depending on the number of transitions that I perform per day.

Enjoy peace of mind with Palmpay and avoid unnecessary charges in this hardship. Be smart and stop wasting your money little by little all in the name of paying direct and indirect charges going to the pocket of those who don’t care about you.

Access to different loan offers

With Palmpay you will always have access to short term loans, no need to ask your friends for urgent 2k to avoid unnecessary insults. Palmpay can give you up to 50k and as long as you repay your loan regularly.

However, they also have a free 15 days loan that comes with no charges or interest of any kind, 100% free. You can use it to pay for your DStv/GOtv, buy data or airtime etc.

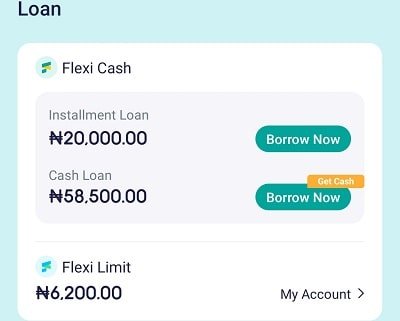

In my Palmpay account I have 3 types of loan offers which is as follows:

- Installment Loan: N20,000

- Cash Loan: N58,500

- Flexi Limit: N6200

As you can see on the screenshot, the installment Loan is a loan offer that you can pay back multiple times, you don’t have to pay all, it will be divided into 2 or 3 times up to 62 days validity to make it easier to repay. I used to have up to 60k in that installment Loan but since I don’t use it they reduced it to 20,000.

Palmpay Cash Loan is not designed to pay installmentally but you can be able to set the amount you want, the loan offer is usually between 7-14 days validity. Another one is Flexi Limit loan, this loan can only be used to pay for utilities, buy airtime, data and fund your sports betting online accounts. That is to say that you won’t be able to withdraw the money to your bank account.

Note: Palmpay loan charges and interest are not so friendly, don’t borrow carelessly for fun or without any solid plan on how to repay the loan before the due time.

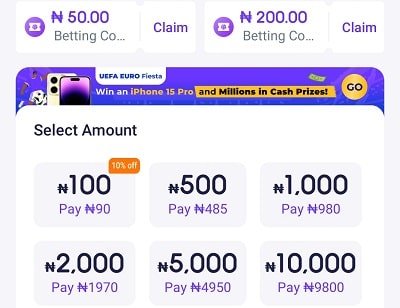

Special offers and discounts for using their services

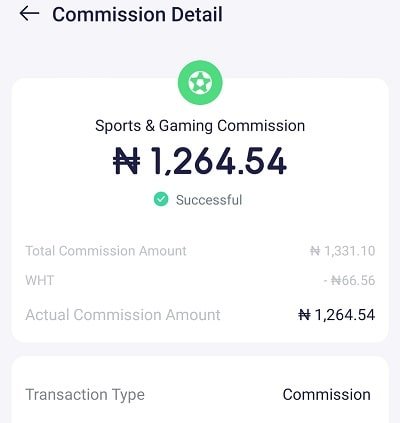

When you use your bank, you pay for charges including ATM maintenance fee, but when you use Palmplay you will be paid for using their services. Based on my personal experience, I receive between 400 to 1k plus daily. You might be saying how right now but let me explain.

I have a sports betting shop which I fund my cashiers using Palmpay and the first 20,000 I fund in a day gives me instant N400. Each 10k that I fund gives me N200. I also receive commission from everything I do with Palmpay because I signed up for Palmpay Commission Plus since I use their service countless times daily. The screenshot is the proof of my claims.

Good customer support

You can always reach Palmpay using the app to chat with their support team instantly if you face any challenges using their service. They also have a phone number that you can use to call them 02018886888.

How secure is Palmpay?

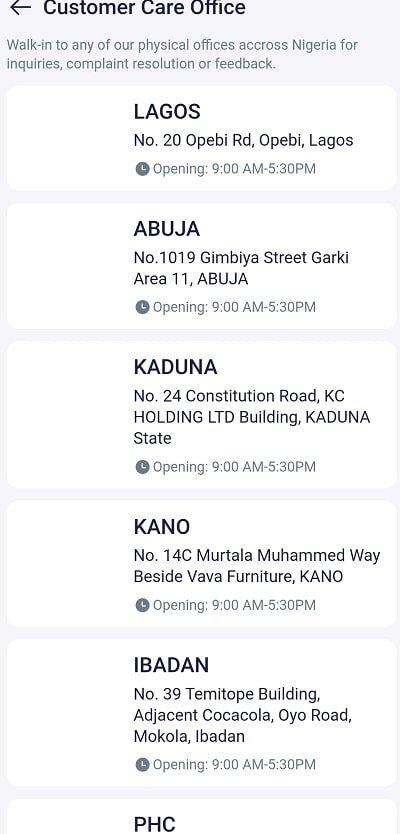

One of the biggest fears many have about Palmpay and their likes is their money being disappeared from their account overnight with no physical address to visit to complain. Well I am an expert when it comes to online security. Moreover, Palmpay has physical address in Lagos, Abuja, PH, Kaduna, Kano and Ibadan

Palmpay is licensed by CBN as an MMO while all deposits are insured by NDIC. Your money is secured 100% but there are things you must do on your own. Never give anyone your Palmpay login Pin to avoid someone gaining access into your account.

You can Join Palmpay using my referral link here to get welcome bonus

Finally, Palmpay opened my eyes to know that I should be getting paid for most of the things my bank is charging me for and I am very happy to stick with them for my daily transaction. If you have any questions don’t hesitate to ask me, I have used Palmpay long enough that I know a lot about them and will be able to answer most of your questions.