Palmpay POS is one of the best POS business providers, with friendly charges and higher profits. They offer easy daily targets, and it’s affordable to purchase.

You can’t talk about the POS business in Nigeria without talking about the Palmpay POS service provider. If you are planning to start a POS business or wish to know more about Palmpay POS Machine Price, Charges, daily target, and how you can get it. This page is for you.

I will tell you everything you need to know about the Palmpay POS business, especially how to get their machine and the charges involved. I congratulate you for coming up with this good idea of starting a POS business with the right platform, like Palmpay. So let’s get down to business, below is the list of the things we will discuss.

- What is POS business, and why choose Palmpay?

- Palmpay machine price, the charges, commissions per transaction, and recommended daily target.

- About Palmpay cautionary fee.

- How to contact Palmpay customer care for help or inquiry.

- The requirements to become a Palmpay agent, distributor, or aggregator.

- How to get a Palmpay POS banner and lots more

What is POS business and why to go for Palmpay POS

A few years ago, the POS business was introduced to ease the pressure in the Nigerian banking sector and to make sending and receiving money easier for Nigerians without any need to go to the bank. POS means a point of sale or point of purchase which is designed to allow Nigerians to carry out certain transactions like:

- Sending and receiving funds

- Buying of data and airtime

- Cable TV Subscriptions.

- Utility bill payments like (NEPA), etc.

However, Palmpay is not the only platform that provides POS machines, you can get it from different banks and other platforms such as Opay, Moniepoint, and the rest.

Many people choose Palmpay because getting their POS machine is simple, with an attractive commission model and favorable charges. However, we will discuss the details to see how and why Palmpay should be your destination if you are planning to start a POS business in Nigeria.

Advantages of using Palmpay POS service

There are numerous reasons why Palmpay is one of the best POS business providers in Nigeria. When you talk about the advantages they have over other providers, then you talk about the following:

- Easy and Unrestricted fund transfer

- Favourable daily target that doesn’t stress you to meet.

- They offer two different types of POS machines that you can choose from.

- Easy cash withdrawal.

- Utility bill payment

- Easy TV subscription

- You can buy data and airtime with ease

- Help your customers check their account balance and lots more.

Palmpay POS Commission and Charges

As someone planning to start a POS business with Palmpay, it’s important to know that there are charges for both withdrawal and deposit.

Withdrawal Charges

As you already know, Palmpay has two different types of POS machines” an Android version and a traditional POS machine” both of the machines charge 0.05% charges on withdrawals. Mathematically, you will be charged #5 for every #1,000 you withdraw. Below are what you should know as a POS agent.

- If you send #1,000 to customer you will be charged #5

- #5,000 will attract #25 naira charge

- If you send #10,000 to a customer, you will be charged #50

- When you withdraw #15,000 for a customer, you will be charged #75

- #20,000 and above will attract #100 charges.

Now, looking at the charges, you will see how profitable the POS business is when you choose Palmpay as your provider. Generally, when you withdraw #5,000 and below in any POS, you will pay #100, and when that happens, they only return #25 and keep #75 as their profit.

Deposit charges and commission

Regarding deposits with the Palmpay POS machine, you will be charged #10 for every deposit made, irrespective of the amount you are depositing. This means that when a customer asks you to help them send money to their account or somewhere else, you will be charged #10 only, even if it’s 50k or 100k, and yet, as a POS agent, you will charge the customer between #100 – #1000 for such transactions.

Commissions on Airtime, Data, Cable TV subscriptions, and utility bill payments

- DSTV subscription: 2%

- GOTV Subscription: 2%

- MTN Data and Airtime: 3%

- Airtel Data and Airtime: 4%

- GLO: 4%

- 9Mobile: 4.5%

Limits on Transfers

Unfortunately, there are some limitations when it comes to transferring money, Palmpay accounts have different levels which determine the limit of the transfer. They have Tier 1, Tier 2 and Tier 3 levels. The good news is that you can upgrade from one level to the other.

Palmpay Tier 1 Account holders have a daily transaction limit of #50,000 and can only hold a maximum balance of #300,000.

Tier 2 account holders have a daily transaction limit of #200,000 and can only hold a maximum balance of #500,000

The biggest one is Tier 3, with a maximum daily transaction of 1 Million and can hold up to 5 million in account balance.

Types of Palmpay POS Machines

Palmpay offers two types of POS machines, and they come with different features. Still, they are designed for the same purpose of sending and receiving funds or carrying out other transactions like utility bill payments, airtime and data purchases, and other transactions.

Palmpay Linux POS

This type of POS machine might be seen as an outdated version with limited features, and operating it might not be as simple as the modern one. However, it still fulfills the main purpose of a POS machine.

Palmpay Smart POS

This type is a modern Android POS machine with amazing features, and the user interface is also great, the handling is simple because it is just like operating your Android smartphone.

How much does it cost to buy a PalmPay POS machine?

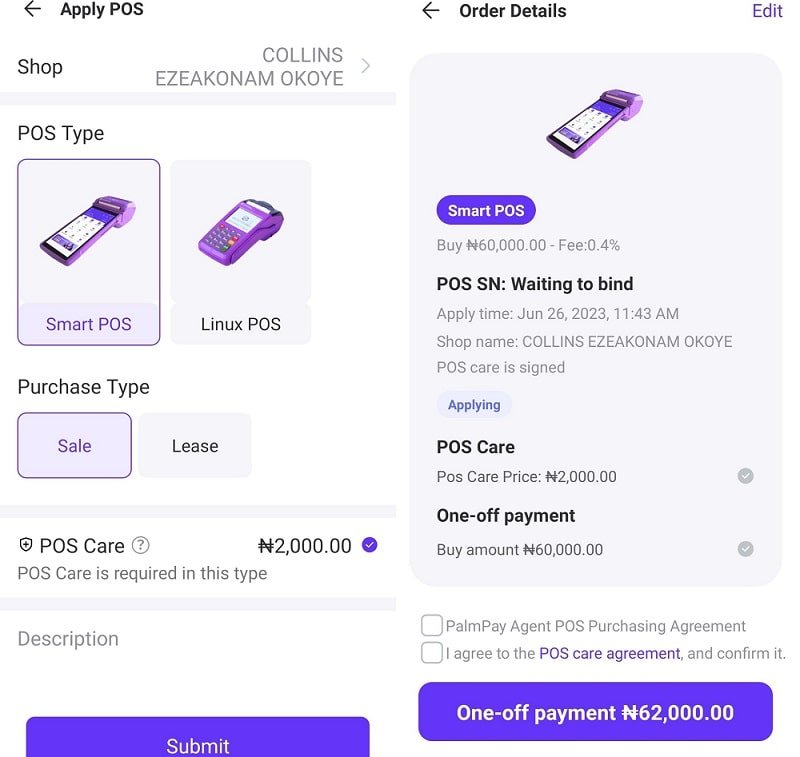

You can actually buy Palmpay POS yourself without any help, all you need is to download the Palmpay Agent app and register. After registration, you will see the option to buy the POS machines depending on what you want and can afford.

Palmpay Linux POS Price

Linux POS machine is cheaper compared to the Smart POS from Palmpay so if you are looking for a more affordable option then consider going for the Linux POS machine.

• Lease Price: N20,000 + POS Care = N22,000

• Outright Purchase: N30,000 + POS Care N2,000 = N32,000

Palmpay Smart POS Price

You will have access to a Palmpay business loan depending on your performance and other amazing benefits when you go for the Palmpay Smart POS Machine.

• Lease Price: N40,000 + POS Care = N42,000

• Outright Purchase: N60,000 + POS Care N2,000 = N62,000

About Palmpay POS Care

You might not understand why the additional N2,000 is being added as POS Care but this covers the hardware and software repairs that might occur within 365 days (one year)

However, there is no difference when it comes to charges for both types of machines, the only difference is their design, features, and purchase prices.

How to get a Palmpay POS machine in Nigeria

You have seen the requirements and most things you need to know about Palmpay POS, what is left now is the process. So to get started, follow the instructions below.

#1. What you must do to get the pay machine is to create an account with them, and how do you do that?

#2. Download the Palmpay POS agent App from the Google Play Store or download the Apple app version from the Apple Store if you use an iPhone. Search for an app called Palmpartner or download it from here if you use an Android phone.

#3. Once you finish downloading and installing the app, you can log in with your old Palmpay account if you have one or sign up for a new account right from the Palm partner mobile app.

#4. After creating an account and being able to log in, the next step is to locate the apply for POS button, click on it, and follow the instructions.

#5. You might be required to upgrade your Palmpay account, and you can do that by going to settings and then to the upgrade account option.

#6. After completing the processes, you will have to wait for the Palmpay customer representative to contact you to finalize your registration and instruct you on what to do next.

How to fund Palmpay POS Machine

When registering for an account, Palmpay will use your phone number to create a business account for you. For example, if your phone is 080399993**, your Palmpay account number will be 80399993** the difference is the first zero (0) in your phone number will be removed to make it a usable 10-digit account number.

With this, you can fund your Palmpay account conveniently by transferring money from any channel to your account number. However, You can still log in to your Palmpay account and fund your account without any stress.

Requirements for getting Palmpay POS Machine

We have discussed the price, charges, and commissions, but now we will look at the requirements before you can open a POS business using Palmpay Machines.

Personal details required

- Your date of birth

- Your full name (first and last name)

- Your phone number

- Your gender (Male or Female)

- Verifiable email address

- Your home and office address

- Your preferred account login username and password

For your identity verification

- Government Issued ID card such as NIN, Voters Card, International Passport or driver’s license

- Utility bills to verify your address, such as NEPA bill

- BVN

- CAC documents for registered business owners

- Your passport photograph

- Your bank account details

Palmpay Contact Phone numbers and email

If you have any issues or wish to inquire about anything about Palmpay, you can reach them with the following phone numbers and email addresses below:

- Phone: 017005700 or 07044834390

- Email address: support@palmpay.co

- Physical office address: No: 20, Opebi Road, Ikeja Lagos, Nigeria.

Finally, I appreciate your time reading this guide, and if you are still unsure how to get a Palmpay POS machine or are still confused about anything, feel free to use the comment option to share your views.